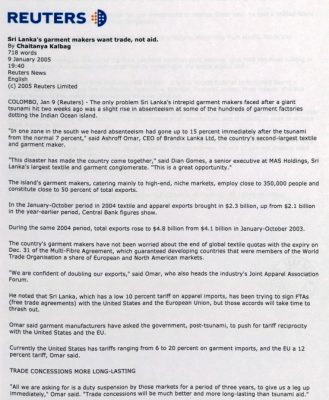

Sri Lanka’s garment makers want trade, not aid

[Reuters]

Published date: 9th Jan 2005

9 January 2005

Reuters News

English

(c) 2005 Reuters Limited

COLOMBO, Jan 9 (Reuters) – The only problem Sri Lanka’s intrepid garment makers faced after a giant tsunami hit two weeks ago was a slight rise in absenteeism at some of the hundreds of garment factories dotting the Indian Ocean island.

“In one zone in the south we heard absenteeism had gone up to 15 percent immediately after the tsunami from the normal 7 percent,” said Ashroff Omar, CEO of Brandix Lanka Ltd, the country’s second-largest textile and garment maker.

“This disaster has made the country come together,” said Dian Gomes, a senior executive at MAS Holdings, Sri Lanka’s largest textile and garment conglomerate. “This is a great opportunity.”

The island’s garment makers, catering mainly to high-end, niche markets, employ close to 350,000 people and constitute close to 50 percent of total exports.

In the January-October period in 2004 textile and apparel exports brought in $2.3 billion, up from $2.1 billion in the year-earlier period, Central Bank figures show.

During the same 2004 period, total exports rose to $4.8 billion from $4.1 billion in January-October 2003.

The country’s garment makers have not been worried about the end of global textile quotas with the expiry on Dec. 31 of the Multi-Fibre Agreement, which guaranteed developing countries that were members of the World Trade Organisation a share of European and North American markets.

“We are confident of doubling our exports,” said Omar, who also heads the industry’s Joint Apparel Association Forum.

He noted that Sri Lanka, which has a low 10 percent tariff on apparel imports, has been trying to sign FTAs (free trade agreements) with the United States and the European Union, but those accords will take time to thrash out.

Omar said garment manufacturers have asked the government, post-tsunami, to push for tariff reciprocity with the United States and the EU.

Currently the United States has tariffs ranging from 6 to 20 percent on garment imports, and the EU a 12 percent tariff, Omar said.

TRADE CONCESSIONS MORE LONG-LASTING

“All we are asking for is a duty suspension by those markets for a period of three years, to give us a leg up immediately,” Omar said. “Trade concessions will be much better and more long-lasting than tsunami aid.” In the past few months, Brandix, which prides itself on being a vertical supplier, has doubled the capacity of its textile processing plant to 4 million yards (metres) a month.

It bought two new plants and two weeks ago broke ground for a new plant that will make jeans for Levi Strauss & Co.

“We are ramping up our plans and are hoping for 30 percent growth,” Omar said.

Brandix counts Limited Brand Inc’s (LTD.N) Victoria’s Secret brand of lingerie, Gap Inc (GPS.N), Liz Claiborne (LIZ.N), Next (NXT.L), Marks & Spencer (MKS.L) and Tommy Hilfiger (TOM.N) among its top clients.

Sri Lanka is also an attractive destination for new investments in textiles, Omar said. He said a knitted-fabric mill has been relocated to the island from Singapore.

A similar tone was sounded by MAS Holdings, which manufactures everything from elastic, fabric and accessories to finished garments.

Gomes, who is managing director of the Sara Lee/MAS Holdings joint venture, says MAS has been looking to expand its design and development capabilities by investing in the entire supply chain.

To that end, MAS has set up joint ventures with Limited – it is the largest supplier to Victoria’s Secret -Triumph International, Sara Lee Courtaulds, Stretchline, Brandot, Textured Jersey, Prym Newey, and lace leader Noyon. It also makes leisurewear for Nike Inc (NKE.N).

MAS employs 23,000 people. It lost three employees to the tsunami. The privately held company had turnover in 2004 of $450 million, up 30 percent from the previous year, Gomes said, and is looking to push to at least $500 million in 2005.

“People think Sri Lanka is full of tailoring shops,” Gomes said. “But companies like MAS have invested a lot of money in bringing design capability into the organisation. We are between 14 and 17 percent cheaper than China and we can hold our own.”