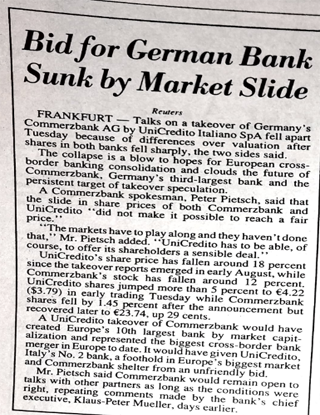

Bid for German Bank Sunk by Market Slide

Published date: 12th Sep 2001, International Herald Tribune

Reuters

FRANKFURT – Talks on a takeover of Germany’s Reuters Commerzbank AG by UniCredito Italiano SpA fell apart Tuesday because of differences over valuation after shares in both banks fell sharply, the two sides said.

The collapse is a blow to hopes for European cross- border banking consolidation and clouds the future of Commerzbank, Germany’s third-largest bank and the persistent target of takeover speculation.

A Commerzbank spokesman, Peter Pietsch, said that the slide in share prices of both Commerzbank and UniCredito “did not make it possible to reach a fair price.”

“The markets have to play along and they haven’t done that,” Mr. Pietsch added. “UniCredito has to be able, of course, to offer its shareholders a sensible deal.” UniCredito’s share price has fallen around 18 percent since the takeover reports emerged in early August, while Commerzbank’s stock has fallen around 12 percent. UniCredito shares jumped more than 5 percent to €4.22 ($3.79) in early trading Tuesday while Commerzbank shares fell by 1.45 percent after the announcement but recovered later to €23.74, up 29 cents.

A UniCredito takeover of Commerzbank would have created Europe’s 10th largest bank by market capitalization and represented the biggest cross-border bank merger in Europe to date. It would have given UniCredito, Italy’s No. 2 bank, a foothold in Europe’s biggest market and Commerzbank shelter from an unfriendly bid.

Mr. Pietsch said Commerzbank would remain open to talks with other partners as long as the conditions were right, repeating comments made by the bank’s chief executive, Klaus-Peter Mueller, days earlier.